NGPF Activity Bank Types of Credit Answers provides a comprehensive resource for understanding the various types of credit available, empowering individuals to make informed financial decisions. This guide delves into the key features, purpose, and effective management strategies for each credit type, equipping readers with the knowledge to navigate the complex world of credit responsibly.

From understanding the basics of credit to implementing practical strategies for managing debt, this guide serves as an invaluable tool for enhancing financial literacy and promoting responsible credit practices.

Overview of Credit Types Offered by NGPF Activity Bank

The NGPF Activity Bank offers a comprehensive suite of credit-related activities designed to enhance financial literacy and promote responsible credit practices. These activities cover a wide range of credit types, each with its unique purpose and key features:

- Consumer Credit:Includes credit cards, personal loans, and lines of credit, primarily used for personal expenses.

- Mortgage Credit:Specifically designed for financing the purchase of real estate, such as homes and apartments.

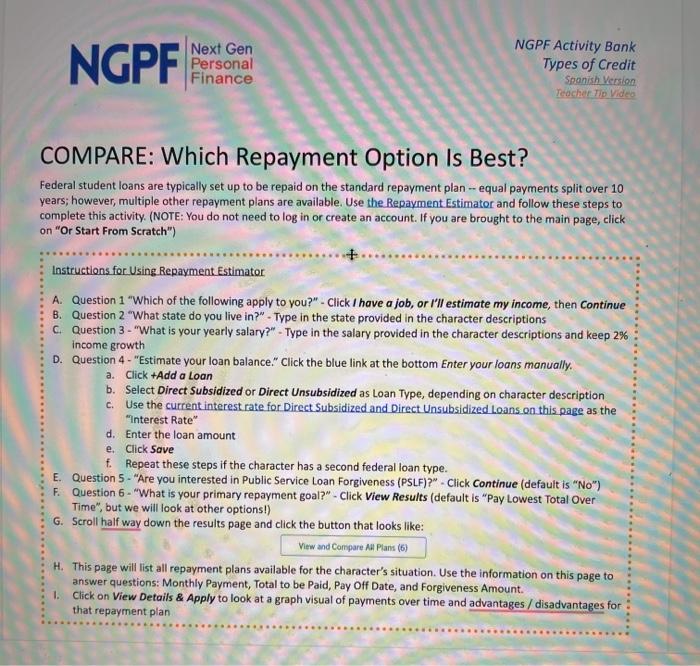

- Student Loans:Government-backed loans intended to cover educational expenses, such as tuition, fees, and living costs.

- Business Credit:Provides funding for business operations, such as equipment purchases, inventory, and working capital.

- Other Credit Types:Includes specialized credit options, such as payday loans, auto loans, and credit-builder loans.

Methods for Understanding and Analyzing Credit Options

Understanding the different credit options available is crucial for making informed financial decisions. The NGPF Activity Bank provides various methods to analyze and compare credit options:

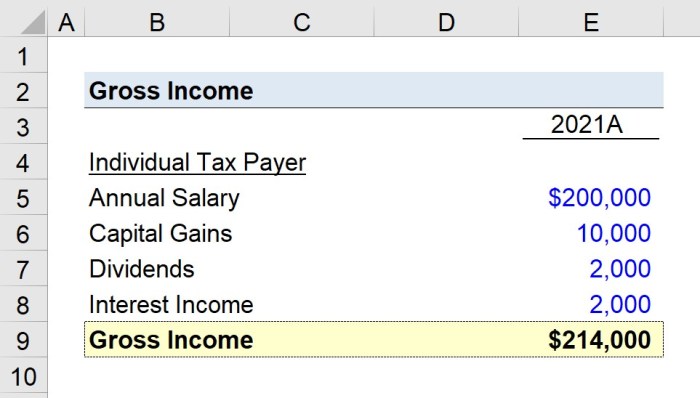

- Credit Scores:Numerical representations of an individual’s creditworthiness, based on factors such as payment history and credit utilization.

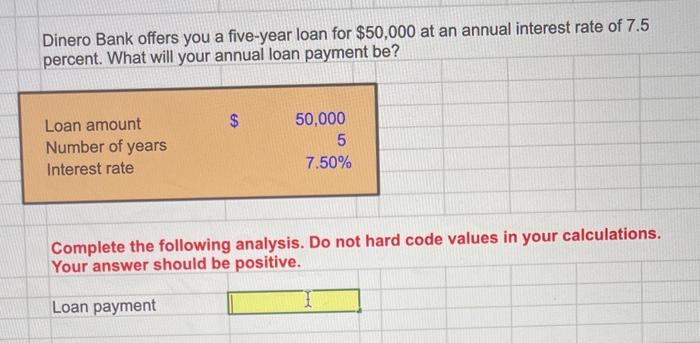

- Interest Rates:The cost of borrowing money, expressed as a percentage of the loan amount.

- Loan Terms:The duration of the loan and the frequency of payments.

- Fees:Additional charges associated with the loan, such as origination fees and late payment penalties.

By carefully considering these factors, individuals can make informed choices about the credit options that best meet their financial needs and goals.

Strategies for Managing Credit Effectively

Responsible credit management is essential for maintaining a healthy financial standing. The NGPF Activity Bank offers practical strategies to help individuals effectively manage their credit:

- Budgeting:Creating a budget to track income and expenses, ensuring that credit is used wisely and payments are made on time.

- Paying Off Debt:Implementing strategies to pay down debt efficiently, such as the debt snowball or debt avalanche methods.

- Avoiding Credit Pitfalls:Understanding and avoiding common credit traps, such as high-interest debt and overspending.

By adhering to these principles, individuals can build and maintain good credit, which is essential for accessing financial products and services at favorable terms.

Educational Resources for Credit Literacy

The NGPF Activity Bank provides a wealth of educational resources to enhance credit literacy:

- Simulations:Interactive simulations that allow individuals to experience the consequences of different credit decisions.

- Games:Gamified learning experiences that make credit concepts more engaging and accessible.

- Lesson Plans:Comprehensive lesson plans for teachers to incorporate credit education into their classrooms.

These resources empower individuals with the knowledge and skills necessary to make informed credit decisions and achieve financial success.

Case Studies and Examples of Credit Management: Ngpf Activity Bank Types Of Credit Answers

The NGPF Activity Bank features real-world case studies and examples to illustrate the impact of credit management:

- Success Stories:Case studies of individuals who have successfully managed their credit, highlighting the principles and strategies they employed.

- Challenges and Pitfalls:Case studies of individuals who have struggled with credit management, analyzing the factors that contributed to their difficulties.

These case studies provide valuable insights into the practical application of credit management principles, helping individuals learn from both positive and negative experiences.

Questions Often Asked

What types of credit are covered in the NGPF Activity Bank?

The NGPF Activity Bank covers a wide range of credit types, including credit cards, personal loans, student loans, mortgages, and lines of credit.

How can I use the NGPF Activity Bank to improve my credit literacy?

The NGPF Activity Bank provides various resources, such as simulations, games, and lesson plans, to enhance credit literacy. These resources can be used to gain a deeper understanding of credit concepts and develop responsible credit practices.

What are some strategies for managing credit effectively?

Effective credit management involves budgeting, paying off debt on time, avoiding excessive credit utilization, and monitoring credit reports regularly.