Dinero bank offers you a five-year loan for 000 – Embark on a comprehensive exploration of Dinero Bank’s exceptional loan offering, meticulously crafted to empower your financial aspirations. This five-year loan, extending a substantial $50,000, presents a transformative opportunity to unlock your goals, whether they involve expanding your business, pursuing higher education, or consolidating debt.

As we delve into the intricacies of this loan, we will meticulously examine its terms and conditions, eligibility requirements, application process, repayment options, potential benefits and drawbacks, and alternative loan considerations. Our aim is to equip you with the knowledge and insights necessary to make an informed decision that aligns with your unique financial circumstances.

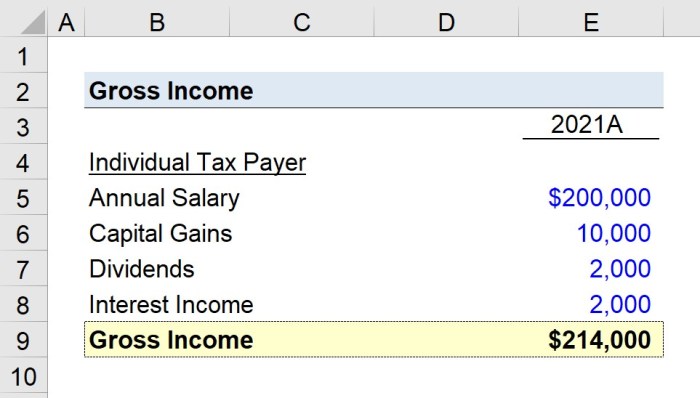

Loan Terms and Conditions

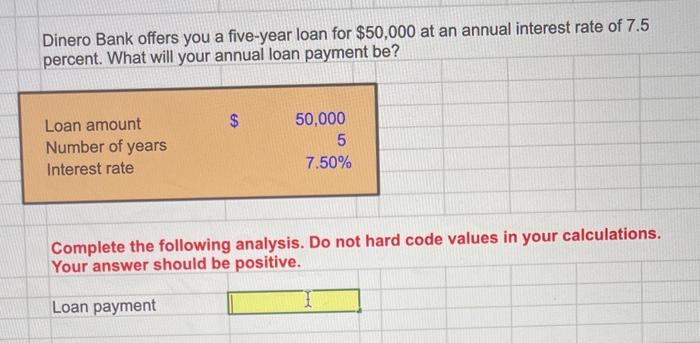

Dinero Bank’s five-year loan of $50,000 comes with specific terms and conditions that govern its usage and repayment. Understanding these terms is crucial before committing to the loan.

Loan Amount and Duration

The loan amount is fixed at $50,000, and the loan duration is five years, or 60 months. This means that the borrower will have to repay the loan in monthly installments over the course of five years.

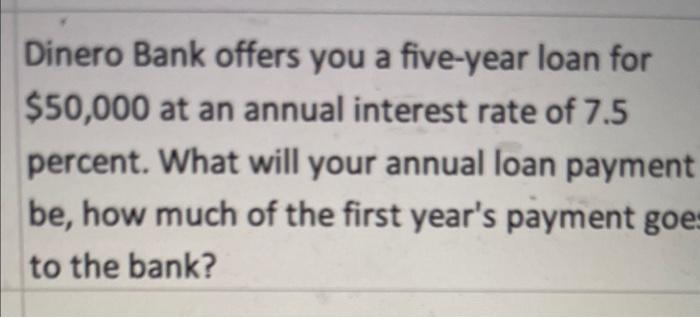

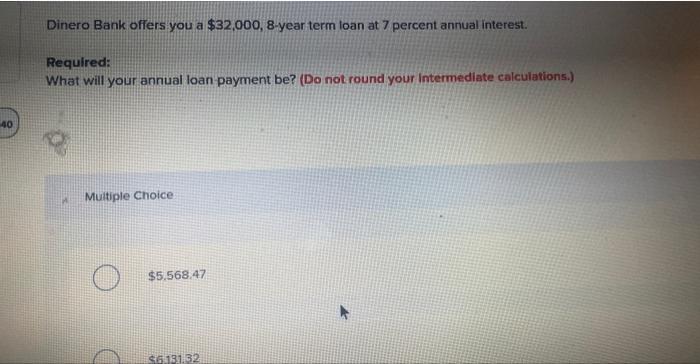

Interest Rate and Monthly Payments

The loan carries an interest rate of 10% per annum. The monthly payments are calculated based on the loan amount, interest rate, and loan duration, and are typically fixed for the entire loan term. The exact monthly payment amount will depend on the specific terms agreed upon between the borrower and Dinero Bank.

Fees and Penalties

Dinero Bank may charge certain fees and penalties associated with the loan. These may include an origination fee, late payment fees, and prepayment penalties. The origination fee is a one-time fee charged at the beginning of the loan, and it covers the administrative costs of processing the loan application.

Late payment fees are charged if the borrower fails to make timely monthly payments, and prepayment penalties may apply if the borrower repays the loan early.

Loan Eligibility and Requirements: Dinero Bank Offers You A Five-year Loan For 000

To be eligible for Dinero Bank’s five-year loan, borrowers must meet certain criteria and provide the necessary documentation.

Eligibility Criteria

Eligible borrowers typically have a good credit score, a stable income, and a low debt-to-income ratio. Dinero Bank may also consider other factors, such as the borrower’s employment history and assets.

Documentation and Information Required

When applying for the loan, borrowers will need to provide various documents and information, including proof of income, proof of identity, and a credit report. Dinero Bank may also request additional documentation, such as tax returns or bank statements.

Credit Score and Income Requirements

Dinero Bank typically requires borrowers to have a credit score of at least 650 to qualify for the five-year loan. The minimum income requirement may vary depending on the borrower’s credit score and other factors.

Loan Application Process

Applying for Dinero Bank’s five-year loan involves a straightforward process.

Steps Involved

The application process typically involves the following steps:

- Completing an online or in-person loan application

- Providing the required documentation and information

- Submitting the loan application for review

- Waiting for a loan decision

Application Timeline

The application timeline may vary depending on the complexity of the loan application and the volume of applications being processed. However, Dinero Bank typically aims to provide a loan decision within a few business days.

Documentation and Information Required

When applying for the loan, borrowers will need to provide various documents and information, including:

- Proof of income

- Proof of identity

- Credit report

- Additional documentation (if requested)

Loan Repayment Options

Dinero Bank offers flexible repayment options to accommodate the financial circumstances of borrowers.

Repayment Schedule and Minimum Payments

The loan repayment schedule is typically fixed for the entire loan term, and borrowers are required to make monthly payments of a predetermined amount. The minimum monthly payment is calculated based on the loan amount, interest rate, and loan duration.

Prepayment and Refinancing Options

Dinero Bank allows borrowers to prepay their loan without incurring any penalties. Additionally, borrowers may be able to refinance their loan to secure a lower interest rate or adjust the loan term.

Loan Benefits and Drawbacks

Dinero Bank’s five-year loan offers potential benefits and drawbacks that borrowers should carefully consider before applying.

Benefits

Potential benefits of the loan include:

- Fixed interest rate, providing stability in monthly payments

- Flexible repayment options, allowing borrowers to adjust payments as needed

- Competitive interest rates compared to other lending institutions

Drawbacks

Potential drawbacks of the loan include:

- Loan origination fee, which can increase the overall cost of the loan

- Late payment fees, which can add additional costs if payments are missed

- Prepayment penalties, which may apply if the loan is repaid early

Comparison to Other Offerings

Compared to similar loan offerings from other financial institutions, Dinero Bank’s five-year loan may offer competitive interest rates and flexible repayment options. However, borrowers should compare multiple loan options to determine the best fit for their financial needs.

Loan Alternatives

In addition to Dinero Bank’s five-year loan, borrowers may consider alternative loan options that may better suit their specific financial situations.

Personal Loans, Dinero bank offers you a five-year loan for 000

Personal loans are unsecured loans that can be used for a variety of purposes, including debt consolidation, home renovations, and unexpected expenses. Personal loans typically have shorter loan terms and higher interest rates compared to secured loans.

Home Equity Loans

Home equity loans are secured loans that are backed by the borrower’s home equity. These loans typically offer lower interest rates compared to personal loans, but they also carry the risk of losing the home if the loan is not repaid.

Pros and Cons of Alternatives

The pros and cons of each alternative loan option should be carefully considered before making a decision:

- Personal loans:Pros – unsecured, flexible usage; Cons – higher interest rates, shorter loan terms

- Home equity loans:Pros – lower interest rates; Cons – secured by home, risk of foreclosure

Loan Considerations and Implications

Borrowers should carefully consider the terms and conditions of Dinero Bank’s five-year loan and its potential implications before applying.

Importance of Careful Consideration

It is crucial for borrowers to thoroughly understand the loan terms, including the interest rate, monthly payments, fees, and penalties. Failure to do so can lead to financial difficulties and unexpected costs.

Potential Impact on Credit Score and Financial Situation

Taking on a loan can have a significant impact on a borrower’s credit score and overall financial situation. Making timely payments and managing the loan responsibly can help improve the borrower’s credit score. However, missed payments or defaulting on the loan can negatively impact the borrower’s credit score and make it more difficult to obtain future loans.

Tips for Informed Decisions

To make informed decisions about the loan, borrowers should:

- Compare multiple loan options from different lenders

- Consider their financial situation and ability to repay the loan

- Seek professional advice from a financial advisor if needed

FAQ Summary

What are the eligibility requirements for the five-year loan?

To qualify for the loan, you must meet Dinero Bank’s credit score and income requirements. You will also need to provide documentation such as proof of income, employment, and identity.

What are the interest rates and monthly payments for the loan?

The interest rates and monthly payments for the loan will vary depending on your creditworthiness and the loan term you choose. You can contact Dinero Bank for a personalized quote.

Are there any fees associated with the loan?

There may be fees associated with the loan, such as an origination fee or a late payment fee. You should carefully review the loan agreement before signing to understand all of the fees that may apply.