A company made no adjusting entry for accrued and unpaid – In the realm of financial reporting, the concept of accrual accounting stands paramount, mandating the recognition of expenses and revenues when incurred or earned, regardless of cash flow. However, when a company fails to adjust for accrued and unpaid expenses, the financial statements may be materially misstated, leading to erroneous decision-making and compromised financial analysis.

This comprehensive analysis delves into the consequences of failing to record accrued expenses, exploring its impact on the balance sheet and income statement, as well as its potential implications for financial stakeholders. Moreover, the discussion encompasses real-world examples, estimation methods, recording procedures, internal controls, and auditing considerations, providing a holistic understanding of this critical accounting practice.

1. Accrual Accounting and Adjusting Entries

Concept of Accrual Accounting

Accrual accounting recognizes transactions and events when they occur, regardless of when cash is received or paid. It provides a more accurate picture of a company’s financial performance and position by matching revenues with expenses in the period in which they are earned and incurred, respectively.

Purpose of Adjusting Entries

Adjusting entries are made at the end of an accounting period to ensure that the financial statements reflect all accrued and unpaid revenues and expenses. They correct for transactions that have occurred but have not yet been recorded in the accounting system.

Types of Adjusting Entries

Common types of adjusting entries include:

- Accrued revenues: Revenues earned but not yet received in cash

- Accrued expenses: Expenses incurred but not yet paid in cash

- Prepaid expenses: Expenses paid in advance

- Deferred revenues: Revenues received in advance

Rationale for Recording Accrued and Unpaid Expenses

Recording accrued expenses is crucial because it ensures that expenses are matched with the period in which they are incurred. This provides a more accurate picture of the company’s financial performance and allows for better decision-making.

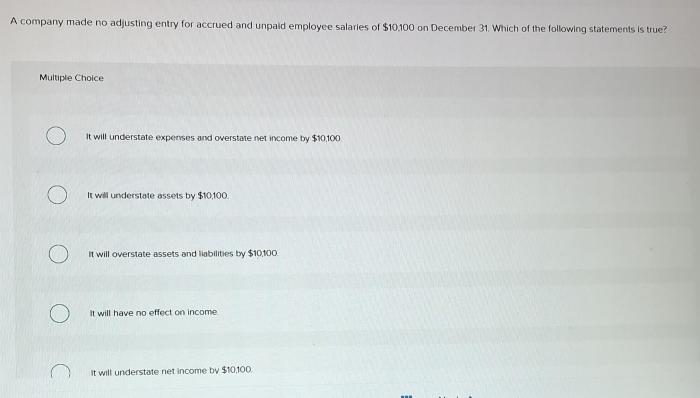

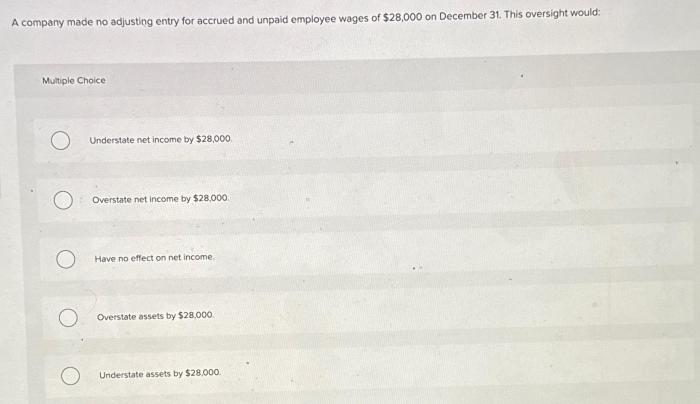

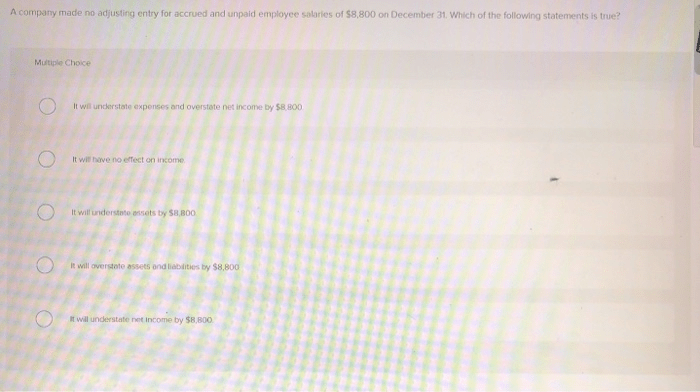

2. Impact of Not Recording Accrued Expenses: A Company Made No Adjusting Entry For Accrued And Unpaid

Consequences of Failing to Record Accrued Expenses, A company made no adjusting entry for accrued and unpaid

Failing to record accrued expenses can have significant consequences:

- Overstated net income: Expenses not recorded reduce expenses and inflate net income, leading to an inaccurate financial picture.

- Understated liabilities: Accrued expenses represent liabilities that are not recognized on the balance sheet, resulting in an understatement of total liabilities.

- Misleading financial analysis: Inaccurate financial statements can lead to incorrect financial analysis and decision-making.

3. Examples of Accrued and Unpaid Expenses

Real-World Examples

Examples of accrued and unpaid expenses include:

| Type | Description |

|---|---|

| Accrued Salaries | Salaries earned by employees but not yet paid |

| Accrued Interest | Interest incurred on loans or investments but not yet paid |

| Accrued Utilities | Utilities consumed but not yet billed |

| Accrued Rent | Rent incurred but not yet paid |

| Accrued Taxes | Taxes owed but not yet paid |

Specific Circumstances

Accruals arise in various circumstances, such as:

- Time lag between service provision and payment

- Periodic expenses that are not paid evenly throughout the year

- Estimates of expenses that cannot be precisely determined until a later date

4. Methods for Estimating Accrued Expenses

Common Methods

Methods for estimating accrued expenses include:

- Percentage of completion: Estimating expenses based on the percentage of work completed

- Aging analysis: Estimating expenses based on the age of outstanding invoices

- Historical data: Using historical data to estimate future expenses

- Industry benchmarks: Using industry averages or benchmarks to estimate expenses

Advantages and Disadvantages

| Method | Advantages | Disadvantages |

|---|---|---|

| Percentage of completion | Accurate for projects with clear milestones | May be difficult to estimate progress |

| Aging analysis | Useful for accounts payable | May not be accurate for all types of expenses |

| Historical data | Simple and straightforward | May not be reliable for changing circumstances |

| Industry benchmarks | Provides external validation | May not be specific to the company’s situation |

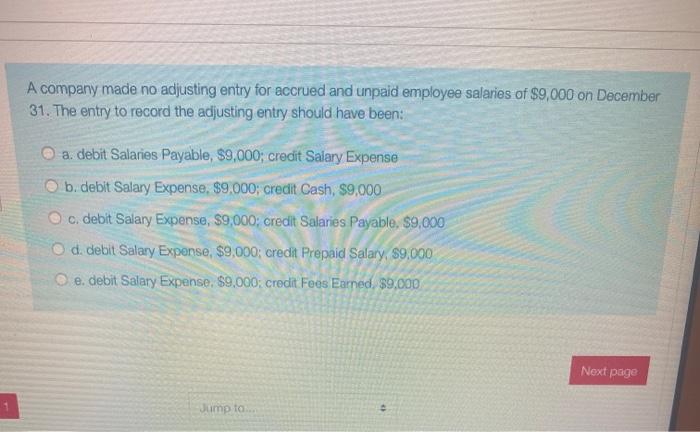

5. Procedures for Recording Accrued Expenses

Step-by-Step Procedures

To record accrued expenses:

- Determine the amount of the accrued expense

- Create an adjusting entry to debit an expense account and credit an accrued liability account

- Post the adjusting entry to the general ledger

Journal Entries

The journal entries for recording accrued expenses typically follow this format:

- Debit: Expense account

- Credit: Accrued liability account

6. Internal Controls for Accrued Expenses

Importance of Internal Controls

Internal controls are essential for ensuring the accuracy and reliability of accrued expense records. They help prevent errors, fraud, and misstatements.

Key Control Activities

Key control activities related to accrued expenses include:

- Proper authorization of expenses

- Review and approval of invoices

- Reconciliation of accrued expenses with supporting documentation

- Periodic review of accrued expense accounts

Strengthening Internal Controls

To strengthen internal controls over accrued expenses, companies can:

- Implement a formal expense approval process

- Require supporting documentation for all expenses

- Establish clear guidelines for recording accrued expenses

- Train employees on accrued expense accounting procedures

7. Auditing Considerations for Accrued Expenses

Auditing Procedures

Auditors use various procedures to verify accrued expenses, including:

- Reviewing supporting documentation

- Performing analytical procedures

- Testing the reasonableness of accrued expense estimates

Analytical Procedures

Analytical procedures can help auditors detect potential misstatements in accrued expenses. For example, they can compare current accrued expenses to historical data or industry benchmarks.

Auditor’s Responsibility

Auditors are responsible for evaluating the adequacy of a company’s internal controls over accrued expenses. They must assess the risk of material misstatement and design audit procedures to address those risks.

User Queries

What is the purpose of recording accrued expenses?

Recording accrued expenses ensures that expenses are recognized in the period in which they are incurred, regardless of when payment is made. This provides a more accurate representation of a company’s financial performance and position.

What are the consequences of failing to record accrued expenses?

Failing to record accrued expenses can lead to an understatement of expenses and liabilities on the balance sheet, and an overstatement of net income on the income statement. This can mislead financial statement users and impair decision-making.

What methods can be used to estimate accrued expenses?

Common methods for estimating accrued expenses include the aging of accounts payable, analysis of historical data, and the use of industry benchmarks. The choice of method depends on the nature of the expense and the availability of reliable data.