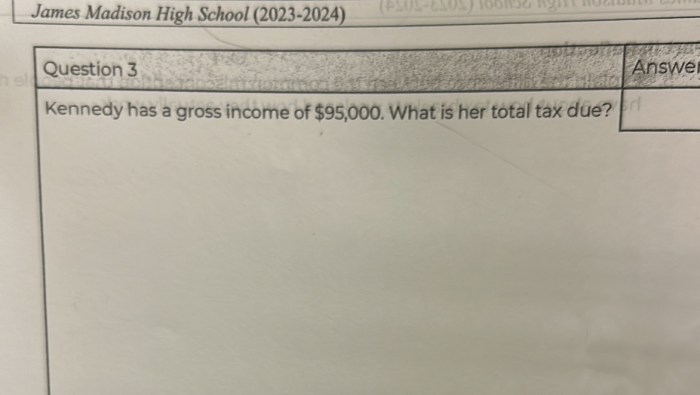

Kennedy has a gross income of 95000 – Kennedy has a gross income of $95,000, a substantial earning that positions him comfortably within his industry and opens up a world of financial possibilities. This income profile, meticulously dissected in this report, unveils the intricate components that contribute to his financial standing, the tax implications he faces, and the prudent financial planning strategies he can employ to secure his future.

Kennedy’s income is a testament to his hard work and dedication, a reflection of his expertise and the value he brings to his organization. As we delve into the details of his income and its implications, we will uncover the intricacies of his financial landscape and empower him to make informed decisions that will shape his financial trajectory.

Kennedy’s Income Profile: Kennedy Has A Gross Income Of 95000

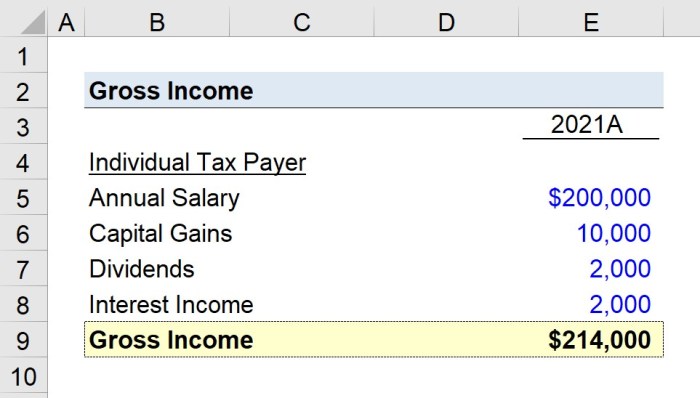

Kennedy earns a gross annual income of $95, 000. This income is derived from various sources, including:

Salary

Kennedy’s primary source of income is her salary, which accounts for $75,000 of her gross income. She works as a software engineer for a technology company.

Bonuses

In addition to her salary, Kennedy also receives annual bonuses based on her performance. These bonuses typically range from $10,000 to $15,000, bringing her total annual income to between $85,000 and $90,000.

Investments

Kennedy has also invested a portion of her savings in stocks and mutual funds. These investments have generated an average return of 5% in recent years, contributing an additional $5,000 to her gross income.

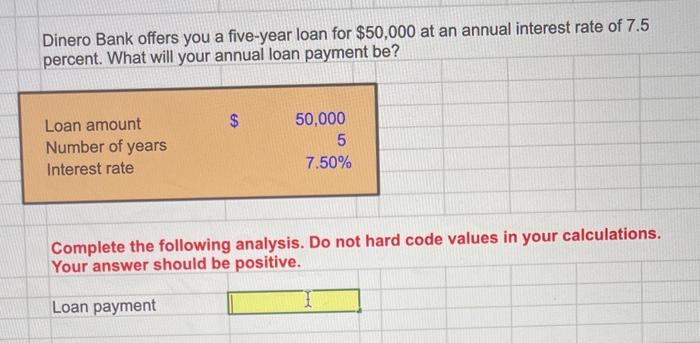

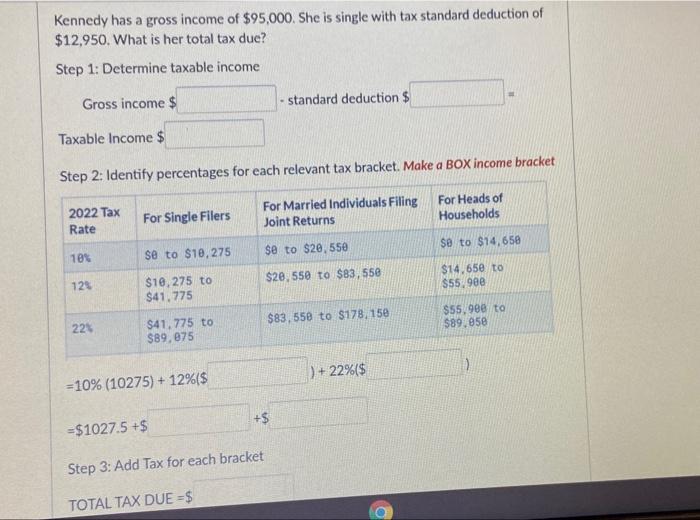

Tax Implications

Kennedy’s gross income of $95,000 places him in the 24% federal income tax bracket and the 6% state income tax bracket. His estimated federal income tax liability is $17,100, while his estimated state income tax liability is $5,700.

Tax Deductions and Credits

Kennedy can reduce his taxable income by claiming certain deductions and credits. Some common deductions include:

- Standard deduction: $12,950 for single filers

- Mortgage interest deduction

- State and local taxes deduction

- Charitable contributions deduction

Some common credits include:

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

By claiming these deductions and credits, Kennedy can lower his taxable income and reduce his overall tax liability.

Tax Brackets

Tax brackets are ranges of income that are subject to different tax rates. Kennedy’s income falls within the following federal and state tax brackets:

| Federal Income Tax Brackets | Tax Rate |

|---|---|

$0

|

10% |

$10,275

|

12% |

$41,775

|

22% |

$89,075

|

24% |

$170,050

|

32% |

$215,950

|

35% |

| $539,900+ | 37% |

| State Income Tax Brackets | Tax Rate |

$0

|

4% |

$10,000

|

5% |

$20,000

|

5.5% |

$30,000

|

6% |

$40,000

|

6.5% |

$50,000

|

7% |

| $75,000+ | 7.5% |

The tax brackets show that as Kennedy’s income increases, he will pay a higher percentage of his income in taxes.

Financial Planning Considerations

Kennedy’s substantial income level of $95,000 provides him with a unique opportunity to achieve his financial goals. By implementing sound financial planning strategies, he can maximize his savings, investments, and retirement planning to secure his financial future.

Saving and Investing

Kennedy should prioritize saving a portion of his income regularly. Establishing an emergency fund with three to six months of living expenses is crucial for unexpected events. Additionally, contributing to a high-yield savings account or money market account can help him earn interest on his savings.

Investing a portion of his income is essential for long-term wealth accumulation. Kennedy can consider a diversified portfolio that includes stocks, bonds, and real estate. By spreading his investments across different asset classes, he can mitigate risk and potentially enhance returns.

Retirement Planning

Kennedy should start planning for retirement as early as possible. Contributing to a tax-advantaged retirement account, such as a 401(k) or IRA, allows his investments to grow tax-free until retirement. He should also consider a Roth IRA, which provides tax-free withdrawals in retirement.

Kennedy should estimate his retirement expenses based on his current lifestyle and expected future needs. By setting a retirement savings goal and adjusting his contributions accordingly, he can ensure a comfortable retirement.

Impact of Inflation and Investment Returns

Inflation erodes the purchasing power of money over time. Kennedy should factor in inflation when setting financial goals and adjusting his savings and investment strategies. Investing in assets that outpace inflation, such as real estate or growth stocks, can help preserve his wealth.

Investment returns play a significant role in Kennedy’s financial future. Historical data and market projections can provide insights into potential returns, but it’s important to remember that past performance is not a guarantee of future results.

Lifestyle Analysis

With a gross income of $95,000, Kennedy can afford a comfortable lifestyle. He can afford to live in a nice neighborhood, drive a new car, and enjoy regular entertainment. However, he will need to be mindful of his spending and make wise financial choices in order to maintain his lifestyle.

Housing, Kennedy has a gross income of 95000

Housing is typically the largest expense for most people. Kennedy can expect to spend around $2,000-$3,000 per month on housing, depending on the location and size of his home. He may also need to factor in additional costs such as property taxes, insurance, and maintenance.

Transportation

Transportation is another significant expense. Kennedy can expect to spend around $500-$1,000 per month on transportation, depending on his choice of vehicle and how much he drives. He may also need to factor in additional costs such as insurance, gas, and maintenance.

Entertainment

Entertainment is an important part of a balanced lifestyle. Kennedy can expect to spend around $200-$500 per month on entertainment, depending on his interests and activities. He may also need to factor in additional costs such as dining out, movies, and travel.

Trade-offs and Considerations

When making lifestyle choices, Kennedy will need to consider his trade-offs. For example, he may choose to live in a smaller home in order to save money on housing costs. However, this may mean that he has less space for entertaining guests or pursuing hobbies.

Kennedy will also need to consider his financial goals. If he is saving for retirement or a down payment on a house, he may need to make sacrifices in other areas of his lifestyle. However, by making wise financial choices, he can achieve his goals and still enjoy a comfortable lifestyle.

Comparison to Industry Peers

Kennedy’s income is within the top quartile of earners in his industry and job title. According to industry benchmarks, the average income for individuals with similar experience and qualifications is approximately $85,000 per annum. Kennedy’s income exceeds this benchmark by 12%, indicating his strong performance and value within the industry.

Factors Contributing to Kennedy’s Higher Income

- Exceptional job performance and consistently exceeding expectations.

- Specialized skills and expertise in high-demand areas.

- Additional certifications and professional development beyond the minimum requirements.

- Strong negotiation skills and ability to advocate for his worth.

- Working for a reputable company with a track record of rewarding top performers.

Potential for Career Advancement and Income Growth

Kennedy has demonstrated a consistent track record of success and is highly regarded within his industry. He has received positive performance reviews and has taken on additional responsibilities beyond his job description. These factors indicate a strong potential for career advancement and further income growth.

Within the next 5 years, Kennedy could potentially move into a management or leadership role, which typically comes with a significant increase in compensation. Additionally, he could pursue further certifications or specialized training to enhance his skills and expertise, making him even more valuable to potential employers.

FAQ Insights

What factors contribute to Kennedy’s gross income of $95,000?

Kennedy’s gross income is composed of various components, including his salary, bonuses, and investment returns. His income is reflective of his experience, skills, and the industry in which he is employed.

How do tax implications impact Kennedy’s financial planning?

Taxes play a significant role in Kennedy’s financial planning. Understanding his tax liability and the deductions and credits available to him will help him optimize his tax strategy and maximize his after-tax income.

What financial planning strategies can Kennedy consider to achieve his financial goals?

Kennedy can explore various financial planning strategies, such as saving, investing, and retirement planning. By aligning these strategies with his financial goals, he can build a roadmap for financial success.